BCashflow Positive’s debtor finance is a flexible funding alternative used by businesses to improve their cash flow. Debtor finance allows businesses to finance their receivables and release the cash tied up in their unpaid invoices. It helps businesses to cover the gap of slow payments by getting their invoices paid in as quick as 4 hours, instead of waiting up to 90 days for their clients to pay.

Debtor Finance

Debtor finance can help businesses when invoice payments are not forthcoming. By freeing up the funds owed to you by your clients, we help you to run your business with greater peace of mind.

Here at BCashflow Positive, we help small and medium enterprises to enjoy a flexible cash flow solution. By freeing up funds in as little as 4 hours, you know that you’ll always have the cash flow needed to pay staff, purchase materials, and settle your own invoices. If slow invoice payments have caused issues for your SME in the past, then BCashflow Positive’s debtor finance could provide the solution that you have been searching for. To find out more, ask for an instant quote or call our experts today.

How Does Debtor Finance Work?

1. Send us your invoices

Invoice your clients and send us a copy

2. Cash in 4 hours

We process your invoices and advance up to 90% of the invoice value

3. When paid – You get the rest

Receive the remainder when your customer paysWho Can Benefit From Debtor Finance?

Growing Companies

We help turn sales invoices into immediate cash so you can take on new opportunies and grow your business.

Startup & Turnaround

Got a growing pipeline or need to turn your business around but the banks won’t help? Speak to us today.

Companies suffering from slow payments

Don’t let slow payments hold your business back. We convert invoices into cash in as quick as 4 hours.

Companies with poor cash flow

Unlock the hidden assets in your invoices now and improve your cash flow.Instant Quote - No Hidden Fees

Funds in 4 hours

$90,000Total Fees

$1,800Debtor Finance Experts Since 1989

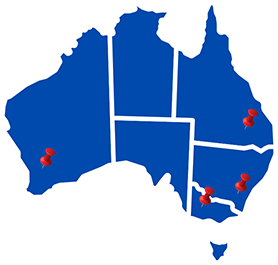

For over 30+ years we have been helping to relieve cash flow pressures suffered by Australian businesses from slow payments, rapid growth, the GFC, ATO debts, and the lack of support provided by their banks.

Our goal is to assist our clients at every stage of their business with transparency, flexibility and top notch customer service.

We engaged BCashflow Positive to get on top of our ATO obligations. Constant cash flow allows us to meet our operating expenses and grow our business.

Accountant

Earthmoving Company, QLD

Simple To Apply

1. Contact us

Speak to our experts about a tailored cash flow solution to suit your business.

2. Approval

There is no charge to provide you with an approval.

3. Document & Settlement

Should you choose to accept your approval, we will actively work with you to get your invoices funded quick smart.Speak to a cash flow expert

No property security

Approval in 24 hours

No hidden fees

No quarterly audits

FAQs

What is debtor finance?

What are the benefits of debtor finance?

- Provides companies with instant cash flow

- BCashflow Positive can help reduce businesses’ debtors risk with free customer credit checks and ongoing monitoring

- Businesses can take advantage of suppliers’ early payment discounts

- Helps companies get on top of their ATO obligations

How much does debtor finance cost?

BCashflow Positive debtor finance costs 1.8% for the first 30 days and 0.06% per day thereafter for up to 90 days. Access our funding calculator to see how much funding you can get and how much it is going to cost upfront.

How soon can I get funding?

Invoices are processed on the same day and funds are credited to your account in as quick as 4 hours.

How much do I get?

Up to 90% of the invoice face value less 1.8% (fee for the first 30 days) is credited to you in as quick as 4 hours. The remaining 10% of the invoice face value less any accrued fees, is transferred to you when your customer pays us.

How long does it take to get approval for debtor finance?

BCashflow Positive provides a response in as quick as 24 hours of receiving your application.

How Does Debt Factoring Work?

Debt factoring or debtor factoring is simpler than a bank loan, and with reasonable and transparent fees, it can provide the flexible cash flow solution that meets your business needs.

If you have had difficulties with slow invoice payments in the past, then talk to one of the experts at BCashflow Positive. We’ll respond to your request in as little as 24 hours so that you can receive approval for finance sooner. Once your approval has gone through, the process couldn’t be simpler. Simply send us a copy of your invoices when you invoice your clients, and we’ll pay it. We process your invoices the same day and advance up to 90% of the invoice value, which could be in your bank account in as little as 4 hours. You will then receive the remainder of the invoiced value when your customer pays us.

Ask About The Benefits Of Invoice Debtor Finance

If you have any questions about invoice debtor finance, then the BCashflow Positive team are here to help. We’re upfront and honest about our terms and our fees so that you can enjoy greater peace of mind.

We charge a low rate of 1.8% for the first 30 days, and 0.06% per day thereafter for up to 90 days. If you ever want to receive a quick quote, then you can use our online calculator.

Using BCashflow Positive will make sense for a range of businesses. If you have struggled with bank loans in the past, or want to take advantage of a supplier’s early

Find Out More By Contacting BCashflow Positive

If you’re not quite sure whether debt factoring is the right option for your business, then why not arrange to speak with someone from BCashflow Positive today. Our experts can help reduce businesses’ debtors’ risk with free customer credit checks and ongoing monitoring.

Here at BCashflow Positive, we can help to cover the gap of slow payments so your business can become cash flow positive.

Fill out the online enquiry form, send us an email, or give us a call today. Our friendly and experienced team can provide approval or answer your questions and help you to run a business that’s cash flow positive.