Poor cash flow can pose significant challenges for any business. BCashflow Positive’s cash flow finance can improve your company’s cash flow by converting your invoices into immediate cash. It is a great alternative funding option for businesses needing additional working capital to finance growth and to keep on top of operating expenses.

Cash Flow Finance Australia Trusts

When it’s time to get on top of your cash flow, BCashflow Positive’s cash flow finance services can help. If you’ve ever found yourself wishing that your clients would pay invoices the same day you send them, then you could benefit from the cash flow finance Australia trusts.

For over three decades, our experts have helped businesses to access the potential of their unpaid invoices. By utilising cash flow finance, your business could grow pipelines and relieve the stress of poor cash flow.

If you believe that cash flow finance could provide the solution you’ve been searching for, then why not speak with our team today. We can walk you through the options and tailor a service to benefit your business.

How Does Cash flow Finance Work?

1. Send us your invoices

Invoice your clients and send us a copy

2. Cash in 4 hours

We process your invoices and advance up to 90% of the invoice value

3. When paid – You get the rest

Receive the remainder when your customer pays

Who Can Benefit From Cash Flow Finance?

Growing Companies

We help turn sales invoices into immediate cash so you can take on new opportunies and grow your business.

Startup & Turnaround

Got a growing pipeline or need to turn your business around but the banks won’t help? Speak to us today.

Companies suffering from slow payments

Don’t let slow payments hold your business back. We convert invoices into cash in as quick as 4 hours.

Companies with poor cash flow

Unlock the hidden assets in your invoices now and improve your cash flow.

Instant Quote - No Hidden Fees

Funds in 4 hours

$90,000Total Fees

$1,800Cash Flow Finance Experts Since 1989

For over 30+ years we have been helping to relieve cash flow pressures suffered by Australian businesses from slow payments, rapid growth, the GFC, ATO debts, and the lack of support provided by their banks.

Our goal is to assist our clients at every stage of their business with transparency, flexibility and top notch customer service.

Simple To Apply

1. Contact us

Speak to our experts about a tailored cash flow solution to suit your business.

2. Approval

There is no charge to provide you with an approval.

3. Document & Settlement

Should you choose to accept your approval, we will actively work with you to get your invoices funded quick smart.Speak to a cash flow expert

No property security

Approval in 24 hours

No hidden fees

No quarterly audits

FAQs

What is cash flow finance?

Why BCashflow Positive’s cash flow finance?

Flexible alternative to finance business growth as cash flow finance is not a loan. The cash you can access is proportionate to your sales.

BCashflow Positive’s cash flow finance lets you stay in control by allowing you to choose which invoices you would like to factor.

BCashflow Positive cash flow finance is suited to a variety of SMEs and growing businesses requiring additional working capital, even start-ups, or companies looking to get on top of their ATO debts, can benefit from cash flow finance.

How much does cash flow finance cost?

1.8% for the first 30 days and 0.06% per day thereafter for up to 90 days. Give our funding calculator a go to see how much funding you can get and how much it is going to cost upfront.

How much do I get?

Up to 90% of the invoice face value less 1.8% (fee for the first 30 days) is made available immediately. BCashflow Positive will transfer you the remaining 10% of the invoice face value less any accrued fees when your customer pays us.

How long does it take to get approval for cash flow finance?

A response is provided in as quick as 24 hours of receiving your application.

Find Out More About The Ways We Can Help Your Business

For clients who want to see their invoices paid on time, BCashflow Positive is here to help. We offer cash flow finance Australia-wide to a variety of small and medium-sized businesses.

Once you’ve received approval as a BCashflow Positive client, you’ll only need to add one simple step to your invoicing process. Just send us a copy of the invoice that you send to your own clients, and we’ll process the invoice and advance up to 90% of its value. You then receive the remainder of the invoice’s value when your customer pays us.

You can expect to enjoy greater cash flow almost immediately, and your customers can still enjoy the same payment terms. Our transparent fees also allow you to see at a glance whether cash flow finance is the right option for your business.

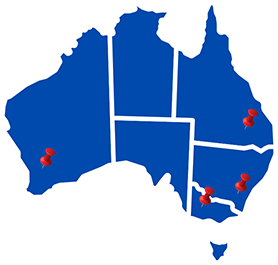

We Offer Cash Flow Finance Australia-Wide

No matter where you are and what type of SME you run, a simple conversation with the team at BCashflow Positive will help you determine whether cash flow finance is the solution that you’ve been searching for.

If you have struggled to receive support from the banks or payment from customers, then we can tailor a solution that meets your needs. We offer cash flow finance Australia wide, with offices across the country. When you want to speak with a local, we are only ever a phone call away.

The team at BCashflow Positive have been helping to relieve cash flow pressures since 1989. We prize customer service, and we tailor our solutions to your unique circumstances so that you see the benefits for your own business.

Contact The BCashflow Positive Team To Learn More

Offering cash flow finance in Australia to businesses large and small lets us know what works for our own clients, and for their customers. If you would like to improve your own cash flow while offering flexible payment options to your customers, then we have the solutions you need.

To talk to the experts in cash flow finance Australia trusts with their invoice financing, contact our team today. Give us a call, send us an email, or fill out the online enquiry form today.